AUTHORS: JACK ROWLAND & EMILY BIRD

READ TIME: 5 MINS

Against a backdrop of mounting regulatory pressure, comms professionals are having to rethink how they structure, design and link their reporting suites. Consultants Jack Rowland and Emily Bird give us their take on what lives where in the world of corporate reporting.

With a proliferation of reporting requirements to contend with and numerous audience groups to keep informed, it’s no great surprise that companies often struggle to work out what to publish and where to put it. How can you determine the best reporting model for your business and create a content plan that really delivers when it comes to audience engagement?

The shockwaves of integration

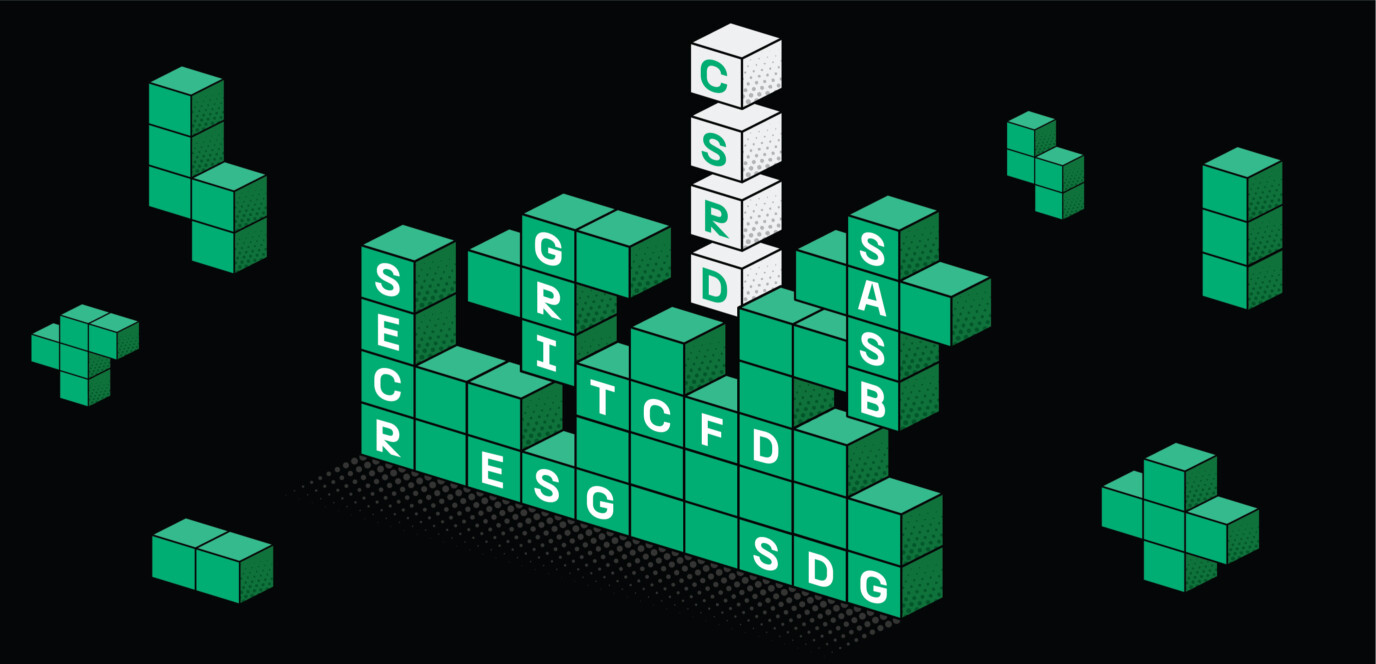

When it comes to compliance, requirements are becoming increasingly stringent. Listed businesses and large private companies will already have felt the effects of TCFD (the Task Force for Climate-Related Disclosure), but CSRD (the Corporate Sustainability Reporting Directive) looks set to shake things up even further.

It will force companies within scope* to re-integrate more (and more detailed) sustainability disclosure into their annual reports – bucking the trend that has seen companies split content across separate reports.

Integrated reporting over integrated reports

While ESG regulators are (quite forcefully) encouraging a more integrated sustainability model, most companies just aren’t there yet. The amalgamation of extensive sustainability content has given rise to dense 300-page reports – with companies often missing the mark by trying to please everyone and include everything in one lengthy document.

There’s no getting around it: the introduction of new integration-focused regulations will undoubtedly lead to more sustainability disclosure within annual reports. But this doesn’t mean we should be including all the information within one vast, impenetrable document.

Bunzl’s a prime example of a business that’s taken the integrated reporting approach and executed it well. Its report leverages streamlined content and combines it with cross-referencing (note the TCFD index table and CSRD-aligned double materiality) to provide an annual report that delivers on detail while also giving content the space to breathe with clever design and visual elements.

Regulation might be at the heart of reporting, but it doesn’t mean companies can’t consider using different formats to help tell their stories as effectively as possible. Nokia communicates with its stakeholders through an annual highlights animation, engaging investors, employees, customers and suppliers.

But this begs the question: what lives where and how can we engage all audiences?

Unfortunately, there’s no ‘one-size-fits-all’ answer, and your reporting approach should really depend on three key things:

1. Your key stakeholders and their needs

2. The size, shape and maturity of your business

3. Business activities and milestones.

“Companies often miss the mark by trying to please everyone and include everything.”

1. Your key stakeholders and their needs

To create an impactful report, you first need to identify who your key stakeholders are and understand why they engage with your disclosure. Different stakeholders want different things, so you might need to adapt your communication style accordingly.

Investors and analysts, for example, are probably looking for performance data, targets and proven results, while consumers and employees are more likely to engage with content that showcases clear messaging and engaging visual elements. This flowchart begins to unpick which stakeholders will be looking for what.

It’s also worth noting here that analysts might be using AI software to read annual reports: this means that data provided in locked-up infographics should also be included within ‘AI readable’ tables or copy, to make it machine-readable.

| Stakeholder | What they might be looking for | How they want to find it | Format |

|---|---|---|---|

| Investors | Data and results around financial and environmental performance Market context Innovation Outlook and prospects |

Comparable figures and tables alongside a clear and thorough written narrative | Investor presentations Annual Reports ESG data packs |

| Analysts | Data and results around financial and environmental performance | Comparable figures and tables alongside a clear and thorough written narrative | ESG data packs |

| Employees | Social and governance content | Digestible and engaging content broken up into clear sections | Webinars Internal sites |

| Customers and consumers | ESG disclosure Products and services |

Digestible and engaging content broken up into clear sections | Fact sheets Microsite Online fast-reads |

| Suppliers | Environmental, governance and supply chain information | Accessible figures and data against performance | Roadshows Data packs |

So who’s doing it well? Tesco reports on a number of sustainability-related areas, frameworks and regulatory requirements for different stakeholder groups. In a really intuitive way, Tesco’s digital sustainability reporting hub splits the content into various sections, from reports and factsheets to methodologies and policies.

It allows users to filter content by date and topic and also brings the most-clicked content to the top of the page, displayed as highlights. It’s a great example of a digital user experience (UX) that helps different audiences find the information they’re looking for.

2. The size, shape and maturity of your business

Companies come in different shapes, sizes and levels of maturity and this is reflected in reporting. If you don’t have sufficient targets, data or content to create a separate biodiversity report, it’s unlikely to be a good strategy for engagement.

Some larger listed companies have extensive reporting suites, with reports detailing different areas of disclosure. But that’s needed because they have more to say.

The nature of the insurance industry, coupled with Phoenix Group’s sheer size, means it must disclose a wealth of information – hence its publication of an Inclusion and Pay Gap Report, Climate Report, Sustainability Report, Stewardship Report and a Net Zero Transition Plan. Breaking the reporting suite down into more manageable documents allows stakeholders to access the bits they’re interested in, without getting bogged down in unnecessary detail.

Smaller companies, who aren’t bound by as much regulation and don’t have as much to say, might take a different approach.

As an unlisted government company, National Highways is not bound by the same level of regulation as listed businesses. It uses interactive webpages to provide engaging summaries of its Strategic Business Plan and Delivery Plan which feature animations and bright imagery, but comparatively less detailed content because there’s less to report on.

One approach isn’t necessarily better than the other – think about what makes sense for you as a business.

3. Business activities and milestones

It’s a common reporting cliché, but not every company is on the same trajectory. You might be embarking on a new strategy, upping the ante on pay gap reporting or announcing a new plan to reach Net Zero. And while some reporting disclosures are mandatory, there are ways to strategically use reports to highlight progress.

SSE Renewables coincided the launch of its first Net Zero Transition Plan with a roundtable event involving key stakeholders at COP28. With clear cross-referencing between documents, its annual report kept net zero disclosure to a minimum regulatory level, while the separate net zero report explored the topic in more granular detail. As an added bonus, the backdrop of an international conference gave the report some ready-made publicity for launch.

Another example comes from Aston Martin: in celebration of the luxury automotive brand’s 110th anniversary, the latest annual report features a timeline highlighting key developments and milestones alongside a short Q&A with the CEO to showcase the company’s rich past and vision for the future.

The power of cross-referencing

You might have the world’s most engaging reporting suite, but your efforts will be null and void if you don’t clearly cross-reference and signpost what lives where. It’s easy for audiences to get lost in the detail; unable to find the disclosure they’re after, they run out of patience and move on.

Cross-referencing helps direct your readers, creates cohesion across documents and declutters content – especially in the context of streamlined regulatory compliance.

You’d be hard pushed to find an annual report that doesn’t use some form of cross-referencing in 2024, with evolving formats and innovative design providing the potential to make reporting both more effective and easier on the eye.

To answer the question of what lives where: there’s not always a definitive answer – no ‘one size-fits-all’, really.

Know your key stakeholders, understand their needs and be open and honest with communicating strategies, milestones and updates in a way that’s relevant and accessible to them as well as being tailored to your business. If you haven’t already done so, start looking at how you can integrate sustainability-related content to comply with upcoming regulation. And at the crux of all of this is cross-referencing – an absolute must for reporting effectiveness.

Struggling with what to publish and where to put it? Let’s talk!

Appendix

* Companies meeting two of the following conditions will have to comply with the CSRD:

- €50 million in net turnover

- €25 million in assets

- 250 or more employees

In addition, non-EU companies with a turnover of more than €150 million in the EU will also have to comply.